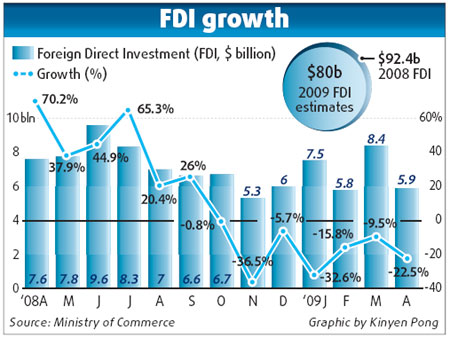

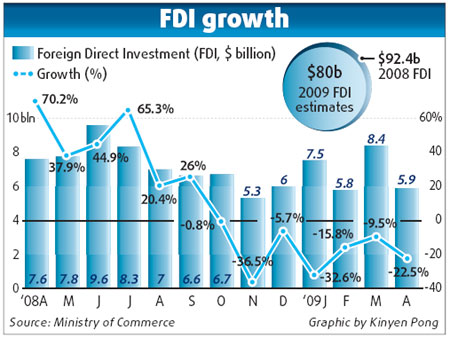

Foreign direct investment (FDI) is investment directly into production in a country by a company located in another country, either by buying a company in the target country or by expanding operations of an existing business in that country. Foreign direct investment is done for many reasons including to take advantage of cheaper wages in the country, special investment privileges such as tax exemptions offered by the country as an incentive to gain tariff-free access to the markets of the country or the region. Foreign direct investment is in contrast to portfolio investment which is a passive investment in the securities of another country such as stocks and bonds. [1] [2] As a part of the national accounts of a country, national income e quation is Y=C+I+G+x-m,I is domestic investment plus foreign investment, FDI refers to the net inflows of investment(inflow minus outflow) to acquire a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor.[3] It is the sum of equity capital, other long-term capital, and short-term capital as shown the balance of payments. It usually involves participation in management, joint-venture, transfer of technology and expertise. There are two types of FDI: inward foreign direct investment and outward foreign direct investment, resulting in a net FDI inflow (positive or negative) and "stock of foreign direct investment", which is the cumulative number for a given period. Direct investment excludes investment through purchase of shares.[4] FDI is one example of international factor movements. The figure below shows net inflows of foreign direct investment in the United States. The largest flows of foreign investment occur between the industrialized countries (North America, Western Europe and Japan). US International Direct Investment Flows:[5] Period FDI Inflow FDI Outflow Net Inflow 1960–69 $ 42.18 bn $ 5.13 bn + $ 37.04 bn 1970–79 $ 122.72 bn $ 40.79 bn + $ 81.93 bn 1980–89 $ 206.27 bn $ 329.23 bn – $ 122.96 bn1990–98 $ 950.47 bn $ 907.34 bn + $ 43.13 bn2000–07 $ 1,629.05 bn $ 1,421.31 bn + $ 207.74 bnTotal $ 2,950.72 bn $ 2,703.81 bn + $ 246.88 bnTypes Horizontal FDI arises when a firm duplicates its home country-based activities at the same value chain stage in a host country through FDI.[6] Platform FDI Vertical FDI takes place when a firm through FDI moves upstream or downstream in different value chains i.e., when firms perform value-adding activities stage by stage in a vertical fashion in a host country.[7] Whereas Horizontal FDI decrease international trade as the product of them is usually aimed at host country, the two other types generally act as a stimulus for it. Methods The foreign direct investor may acquire voting power of an enterprise in an economy through any of the following methods: by incorporating a wholly owned subsidiary or company by acquiring shares in an associated enterprise through a merger or an acquisition of an unrelated enterprise participating in an equity joint venture with another investor or enterprise... Foreign direct investment incentives may take the following forms:[citation needed] low corporate tax and individual income tax rates tax holidays other types of tax concessions preferential tariffs special economic zones EPZ – Export Processing Zones Bonded Warehouses Maquiladoras investment financial subsidies soft loan or loan guarantees free land or land subsidies relocation & expatriation infrastructure subsidies R&D support derogation from regulations (usually for very large projects)Global foreign direct investmentThe United Nations Conference on Trade and Development said that there was no significant growth of Global FDI in 2010. In 2010 was $1,122 billion and in 2009 was $1,114 billion. The figure was 25 percent below the pre-crisis average between 2005 & 2007.[8] Foreign direct investment in the United States Question book-new.svg This section does not cite any references or sources. (June 2011) The United States is the world’s largest recipient of FDI. U.S. FDI totaled $194 billion in 2010. 84% of FDI in the U.S. in 2010 came from or through eight countries: Switzerland, the United Kingdom, Japan, France, Germany, Luxembourg, the Netherlands, and Canada.[9] The $2.1 trillion stock of FDI in the United States at the end of 2008 is the equivalent of approximately 16 percent of U.S. gross domestic product (GDP). Benefits of FDI in America: In the last 6 years, over 4000 new projects and 630,000 new jobs have been created by foreign companies, resulting in close to $314 billion in investment.[citation needed] US affiliates of foreign companies have a history of paying higher wages than US corporations.[citation needed] Foreign companies have in the past supported an annual US payroll of $364 billion with an average annual compensation of $68,000 per employee.[citation needed] Increased US exports through the use of multinational distribution networks. FDI has resulted in 30% of jobs for Americans in the manufacturing sector, which accounts for 12% of all manufacturing jobs in the US. Affiliates of foreign corporations spent more than $34 billion on research and development in 2006 and continue to support many national projects. Inward FDI has led to higher productivity through increased capital, which in turn has led to high living standards.[10][dead link]mm Foreign direct investment in China FDI in China, also known as RFDI (Renminbi foreign direct investment), has increased considerably in the last decade reaching $185 billion in 2010.[11] China is the second largest recipient of FDI globally. FDI into China fell by over one-third in 2009 due the Global Financial Crisis (global macroeconomic factors) but rebounded in 2010.[12] Foreign direct investment in India Starting from a baseline of less than $1 billion in 1990, a recent UNCTAD survey projected India as the second most important FDI destination (after China) for transnational corporations during 2010–2012. As per the data, the sectors which attracted higher inflows were services, telecommunication, construction activities and computer software and hardware. Mauritius, Singapore, US and UK were among the leading sources of FDI. According to Ernst and Young, foreign direct investment in India in 2010 was $44.8 billion, and in 2011 experienced an increase of 13% to $50.8 billion.[13] India has seen an eightfold increase in its FDI in March 2012.[14] India disallowed OCB's i.e. Overseas Corporate Bodies to invest in India .[15] On 14 September 2012, Government of India allowed FDI; in aviation upto 49%, in Broadcast sector upto 74%, in multi-brand retail upto 51% and in single-brand retail upto 100%.[16] Foreign direct investment and the developing world FDI provides an inflow of foreign capital and funds, investment in addition to an increase in the transfer of skills, technology, and job opportunities.[citation needed] Many of the Four Asian Tigers benefited from investment abroad.[citation needed] A recent meta-analysis of the effects of foreign direct investment on local firms in developing and transition countries suggest that foreign investment robustly increases local productivity growth.[17] The Commitment to Development Index ranks the "development-friendliness" of rich country investment policies. Foreign Investment in India is announced by Government of India named as FEMA(Foreign Exchange Management Act)

Foreign direct investment (FDI) is investment directly into production in a country by a company located in another country, either by buying a company in the target country or by expanding operations of an existing business in that country. Foreign direct investment is done for many reasons including to take advantage of cheaper wages in the country, special investment privileges such as tax exemptions offered by the country as an incentive to gain tariff-free access to the markets of the country or the region. Foreign direct investment is in contrast to portfolio investment which is a passive investment in the securities of another country such as stocks and bonds. [1] [2] As a part of the national accounts of a country, national income e quation is Y=C+I+G+x-m,I is domestic investment plus foreign investment, FDI refers to the net inflows of investment(inflow minus outflow) to acquire a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor.[3] It is the sum of equity capital, other long-term capital, and short-term capital as shown the balance of payments. It usually involves participation in management, joint-venture, transfer of technology and expertise. There are two types of FDI: inward foreign direct investment and outward foreign direct investment, resulting in a net FDI inflow (positive or negative) and "stock of foreign direct investment", which is the cumulative number for a given period. Direct investment excludes investment through purchase of shares.[4] FDI is one example of international factor movements. The figure below shows net inflows of foreign direct investment in the United States. The largest flows of foreign investment occur between the industrialized countries (North America, Western Europe and Japan). US International Direct Investment Flows:[5] Period FDI Inflow FDI Outflow Net Inflow 1960–69 $ 42.18 bn $ 5.13 bn + $ 37.04 bn 1970–79 $ 122.72 bn $ 40.79 bn + $ 81.93 bn 1980–89 $ 206.27 bn $ 329.23 bn – $ 122.96 bn1990–98 $ 950.47 bn $ 907.34 bn + $ 43.13 bn2000–07 $ 1,629.05 bn $ 1,421.31 bn + $ 207.74 bnTotal $ 2,950.72 bn $ 2,703.81 bn + $ 246.88 bnTypes Horizontal FDI arises when a firm duplicates its home country-based activities at the same value chain stage in a host country through FDI.[6] Platform FDI Vertical FDI takes place when a firm through FDI moves upstream or downstream in different value chains i.e., when firms perform value-adding activities stage by stage in a vertical fashion in a host country.[7] Whereas Horizontal FDI decrease international trade as the product of them is usually aimed at host country, the two other types generally act as a stimulus for it. Methods The foreign direct investor may acquire voting power of an enterprise in an economy through any of the following methods: by incorporating a wholly owned subsidiary or company by acquiring shares in an associated enterprise through a merger or an acquisition of an unrelated enterprise participating in an equity joint venture with another investor or enterprise... Foreign direct investment incentives may take the following forms:[citation needed] low corporate tax and individual income tax rates tax holidays other types of tax concessions preferential tariffs special economic zones EPZ – Export Processing Zones Bonded Warehouses Maquiladoras investment financial subsidies soft loan or loan guarantees free land or land subsidies relocation & expatriation infrastructure subsidies R&D support derogation from regulations (usually for very large projects)Global foreign direct investmentThe United Nations Conference on Trade and Development said that there was no significant growth of Global FDI in 2010. In 2010 was $1,122 billion and in 2009 was $1,114 billion. The figure was 25 percent below the pre-crisis average between 2005 & 2007.[8] Foreign direct investment in the United States Question book-new.svg This section does not cite any references or sources. (June 2011) The United States is the world’s largest recipient of FDI. U.S. FDI totaled $194 billion in 2010. 84% of FDI in the U.S. in 2010 came from or through eight countries: Switzerland, the United Kingdom, Japan, France, Germany, Luxembourg, the Netherlands, and Canada.[9] The $2.1 trillion stock of FDI in the United States at the end of 2008 is the equivalent of approximately 16 percent of U.S. gross domestic product (GDP). Benefits of FDI in America: In the last 6 years, over 4000 new projects and 630,000 new jobs have been created by foreign companies, resulting in close to $314 billion in investment.[citation needed] US affiliates of foreign companies have a history of paying higher wages than US corporations.[citation needed] Foreign companies have in the past supported an annual US payroll of $364 billion with an average annual compensation of $68,000 per employee.[citation needed] Increased US exports through the use of multinational distribution networks. FDI has resulted in 30% of jobs for Americans in the manufacturing sector, which accounts for 12% of all manufacturing jobs in the US. Affiliates of foreign corporations spent more than $34 billion on research and development in 2006 and continue to support many national projects. Inward FDI has led to higher productivity through increased capital, which in turn has led to high living standards.[10][dead link]mm Foreign direct investment in China FDI in China, also known as RFDI (Renminbi foreign direct investment), has increased considerably in the last decade reaching $185 billion in 2010.[11] China is the second largest recipient of FDI globally. FDI into China fell by over one-third in 2009 due the Global Financial Crisis (global macroeconomic factors) but rebounded in 2010.[12] Foreign direct investment in India Starting from a baseline of less than $1 billion in 1990, a recent UNCTAD survey projected India as the second most important FDI destination (after China) for transnational corporations during 2010–2012. As per the data, the sectors which attracted higher inflows were services, telecommunication, construction activities and computer software and hardware. Mauritius, Singapore, US and UK were among the leading sources of FDI. According to Ernst and Young, foreign direct investment in India in 2010 was $44.8 billion, and in 2011 experienced an increase of 13% to $50.8 billion.[13] India has seen an eightfold increase in its FDI in March 2012.[14] India disallowed OCB's i.e. Overseas Corporate Bodies to invest in India .[15] On 14 September 2012, Government of India allowed FDI; in aviation upto 49%, in Broadcast sector upto 74%, in multi-brand retail upto 51% and in single-brand retail upto 100%.[16] Foreign direct investment and the developing world FDI provides an inflow of foreign capital and funds, investment in addition to an increase in the transfer of skills, technology, and job opportunities.[citation needed] Many of the Four Asian Tigers benefited from investment abroad.[citation needed] A recent meta-analysis of the effects of foreign direct investment on local firms in developing and transition countries suggest that foreign investment robustly increases local productivity growth.[17] The Commitment to Development Index ranks the "development-friendliness" of rich country investment policies. Foreign Investment in India is announced by Government of India named as FEMA(Foreign Exchange Management Act)Sunday, 16 September 2012

Foreign direct investment (FDI)

Foreign direct investment (FDI) is investment directly into production in a country by a company located in another country, either by buying a company in the target country or by expanding operations of an existing business in that country. Foreign direct investment is done for many reasons including to take advantage of cheaper wages in the country, special investment privileges such as tax exemptions offered by the country as an incentive to gain tariff-free access to the markets of the country or the region. Foreign direct investment is in contrast to portfolio investment which is a passive investment in the securities of another country such as stocks and bonds. [1] [2] As a part of the national accounts of a country, national income e quation is Y=C+I+G+x-m,I is domestic investment plus foreign investment, FDI refers to the net inflows of investment(inflow minus outflow) to acquire a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor.[3] It is the sum of equity capital, other long-term capital, and short-term capital as shown the balance of payments. It usually involves participation in management, joint-venture, transfer of technology and expertise. There are two types of FDI: inward foreign direct investment and outward foreign direct investment, resulting in a net FDI inflow (positive or negative) and "stock of foreign direct investment", which is the cumulative number for a given period. Direct investment excludes investment through purchase of shares.[4] FDI is one example of international factor movements. The figure below shows net inflows of foreign direct investment in the United States. The largest flows of foreign investment occur between the industrialized countries (North America, Western Europe and Japan). US International Direct Investment Flows:[5] Period FDI Inflow FDI Outflow Net Inflow 1960–69 $ 42.18 bn $ 5.13 bn + $ 37.04 bn 1970–79 $ 122.72 bn $ 40.79 bn + $ 81.93 bn 1980–89 $ 206.27 bn $ 329.23 bn – $ 122.96 bn1990–98 $ 950.47 bn $ 907.34 bn + $ 43.13 bn2000–07 $ 1,629.05 bn $ 1,421.31 bn + $ 207.74 bnTotal $ 2,950.72 bn $ 2,703.81 bn + $ 246.88 bnTypes Horizontal FDI arises when a firm duplicates its home country-based activities at the same value chain stage in a host country through FDI.[6] Platform FDI Vertical FDI takes place when a firm through FDI moves upstream or downstream in different value chains i.e., when firms perform value-adding activities stage by stage in a vertical fashion in a host country.[7] Whereas Horizontal FDI decrease international trade as the product of them is usually aimed at host country, the two other types generally act as a stimulus for it. Methods The foreign direct investor may acquire voting power of an enterprise in an economy through any of the following methods: by incorporating a wholly owned subsidiary or company by acquiring shares in an associated enterprise through a merger or an acquisition of an unrelated enterprise participating in an equity joint venture with another investor or enterprise... Foreign direct investment incentives may take the following forms:[citation needed] low corporate tax and individual income tax rates tax holidays other types of tax concessions preferential tariffs special economic zones EPZ – Export Processing Zones Bonded Warehouses Maquiladoras investment financial subsidies soft loan or loan guarantees free land or land subsidies relocation & expatriation infrastructure subsidies R&D support derogation from regulations (usually for very large projects)Global foreign direct investmentThe United Nations Conference on Trade and Development said that there was no significant growth of Global FDI in 2010. In 2010 was $1,122 billion and in 2009 was $1,114 billion. The figure was 25 percent below the pre-crisis average between 2005 & 2007.[8] Foreign direct investment in the United States Question book-new.svg This section does not cite any references or sources. (June 2011) The United States is the world’s largest recipient of FDI. U.S. FDI totaled $194 billion in 2010. 84% of FDI in the U.S. in 2010 came from or through eight countries: Switzerland, the United Kingdom, Japan, France, Germany, Luxembourg, the Netherlands, and Canada.[9] The $2.1 trillion stock of FDI in the United States at the end of 2008 is the equivalent of approximately 16 percent of U.S. gross domestic product (GDP). Benefits of FDI in America: In the last 6 years, over 4000 new projects and 630,000 new jobs have been created by foreign companies, resulting in close to $314 billion in investment.[citation needed] US affiliates of foreign companies have a history of paying higher wages than US corporations.[citation needed] Foreign companies have in the past supported an annual US payroll of $364 billion with an average annual compensation of $68,000 per employee.[citation needed] Increased US exports through the use of multinational distribution networks. FDI has resulted in 30% of jobs for Americans in the manufacturing sector, which accounts for 12% of all manufacturing jobs in the US. Affiliates of foreign corporations spent more than $34 billion on research and development in 2006 and continue to support many national projects. Inward FDI has led to higher productivity through increased capital, which in turn has led to high living standards.[10][dead link]mm Foreign direct investment in China FDI in China, also known as RFDI (Renminbi foreign direct investment), has increased considerably in the last decade reaching $185 billion in 2010.[11] China is the second largest recipient of FDI globally. FDI into China fell by over one-third in 2009 due the Global Financial Crisis (global macroeconomic factors) but rebounded in 2010.[12] Foreign direct investment in India Starting from a baseline of less than $1 billion in 1990, a recent UNCTAD survey projected India as the second most important FDI destination (after China) for transnational corporations during 2010–2012. As per the data, the sectors which attracted higher inflows were services, telecommunication, construction activities and computer software and hardware. Mauritius, Singapore, US and UK were among the leading sources of FDI. According to Ernst and Young, foreign direct investment in India in 2010 was $44.8 billion, and in 2011 experienced an increase of 13% to $50.8 billion.[13] India has seen an eightfold increase in its FDI in March 2012.[14] India disallowed OCB's i.e. Overseas Corporate Bodies to invest in India .[15] On 14 September 2012, Government of India allowed FDI; in aviation upto 49%, in Broadcast sector upto 74%, in multi-brand retail upto 51% and in single-brand retail upto 100%.[16] Foreign direct investment and the developing world FDI provides an inflow of foreign capital and funds, investment in addition to an increase in the transfer of skills, technology, and job opportunities.[citation needed] Many of the Four Asian Tigers benefited from investment abroad.[citation needed] A recent meta-analysis of the effects of foreign direct investment on local firms in developing and transition countries suggest that foreign investment robustly increases local productivity growth.[17] The Commitment to Development Index ranks the "development-friendliness" of rich country investment policies. Foreign Investment in India is announced by Government of India named as FEMA(Foreign Exchange Management Act)

Foreign direct investment (FDI) is investment directly into production in a country by a company located in another country, either by buying a company in the target country or by expanding operations of an existing business in that country. Foreign direct investment is done for many reasons including to take advantage of cheaper wages in the country, special investment privileges such as tax exemptions offered by the country as an incentive to gain tariff-free access to the markets of the country or the region. Foreign direct investment is in contrast to portfolio investment which is a passive investment in the securities of another country such as stocks and bonds. [1] [2] As a part of the national accounts of a country, national income e quation is Y=C+I+G+x-m,I is domestic investment plus foreign investment, FDI refers to the net inflows of investment(inflow minus outflow) to acquire a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor.[3] It is the sum of equity capital, other long-term capital, and short-term capital as shown the balance of payments. It usually involves participation in management, joint-venture, transfer of technology and expertise. There are two types of FDI: inward foreign direct investment and outward foreign direct investment, resulting in a net FDI inflow (positive or negative) and "stock of foreign direct investment", which is the cumulative number for a given period. Direct investment excludes investment through purchase of shares.[4] FDI is one example of international factor movements. The figure below shows net inflows of foreign direct investment in the United States. The largest flows of foreign investment occur between the industrialized countries (North America, Western Europe and Japan). US International Direct Investment Flows:[5] Period FDI Inflow FDI Outflow Net Inflow 1960–69 $ 42.18 bn $ 5.13 bn + $ 37.04 bn 1970–79 $ 122.72 bn $ 40.79 bn + $ 81.93 bn 1980–89 $ 206.27 bn $ 329.23 bn – $ 122.96 bn1990–98 $ 950.47 bn $ 907.34 bn + $ 43.13 bn2000–07 $ 1,629.05 bn $ 1,421.31 bn + $ 207.74 bnTotal $ 2,950.72 bn $ 2,703.81 bn + $ 246.88 bnTypes Horizontal FDI arises when a firm duplicates its home country-based activities at the same value chain stage in a host country through FDI.[6] Platform FDI Vertical FDI takes place when a firm through FDI moves upstream or downstream in different value chains i.e., when firms perform value-adding activities stage by stage in a vertical fashion in a host country.[7] Whereas Horizontal FDI decrease international trade as the product of them is usually aimed at host country, the two other types generally act as a stimulus for it. Methods The foreign direct investor may acquire voting power of an enterprise in an economy through any of the following methods: by incorporating a wholly owned subsidiary or company by acquiring shares in an associated enterprise through a merger or an acquisition of an unrelated enterprise participating in an equity joint venture with another investor or enterprise... Foreign direct investment incentives may take the following forms:[citation needed] low corporate tax and individual income tax rates tax holidays other types of tax concessions preferential tariffs special economic zones EPZ – Export Processing Zones Bonded Warehouses Maquiladoras investment financial subsidies soft loan or loan guarantees free land or land subsidies relocation & expatriation infrastructure subsidies R&D support derogation from regulations (usually for very large projects)Global foreign direct investmentThe United Nations Conference on Trade and Development said that there was no significant growth of Global FDI in 2010. In 2010 was $1,122 billion and in 2009 was $1,114 billion. The figure was 25 percent below the pre-crisis average between 2005 & 2007.[8] Foreign direct investment in the United States Question book-new.svg This section does not cite any references or sources. (June 2011) The United States is the world’s largest recipient of FDI. U.S. FDI totaled $194 billion in 2010. 84% of FDI in the U.S. in 2010 came from or through eight countries: Switzerland, the United Kingdom, Japan, France, Germany, Luxembourg, the Netherlands, and Canada.[9] The $2.1 trillion stock of FDI in the United States at the end of 2008 is the equivalent of approximately 16 percent of U.S. gross domestic product (GDP). Benefits of FDI in America: In the last 6 years, over 4000 new projects and 630,000 new jobs have been created by foreign companies, resulting in close to $314 billion in investment.[citation needed] US affiliates of foreign companies have a history of paying higher wages than US corporations.[citation needed] Foreign companies have in the past supported an annual US payroll of $364 billion with an average annual compensation of $68,000 per employee.[citation needed] Increased US exports through the use of multinational distribution networks. FDI has resulted in 30% of jobs for Americans in the manufacturing sector, which accounts for 12% of all manufacturing jobs in the US. Affiliates of foreign corporations spent more than $34 billion on research and development in 2006 and continue to support many national projects. Inward FDI has led to higher productivity through increased capital, which in turn has led to high living standards.[10][dead link]mm Foreign direct investment in China FDI in China, also known as RFDI (Renminbi foreign direct investment), has increased considerably in the last decade reaching $185 billion in 2010.[11] China is the second largest recipient of FDI globally. FDI into China fell by over one-third in 2009 due the Global Financial Crisis (global macroeconomic factors) but rebounded in 2010.[12] Foreign direct investment in India Starting from a baseline of less than $1 billion in 1990, a recent UNCTAD survey projected India as the second most important FDI destination (after China) for transnational corporations during 2010–2012. As per the data, the sectors which attracted higher inflows were services, telecommunication, construction activities and computer software and hardware. Mauritius, Singapore, US and UK were among the leading sources of FDI. According to Ernst and Young, foreign direct investment in India in 2010 was $44.8 billion, and in 2011 experienced an increase of 13% to $50.8 billion.[13] India has seen an eightfold increase in its FDI in March 2012.[14] India disallowed OCB's i.e. Overseas Corporate Bodies to invest in India .[15] On 14 September 2012, Government of India allowed FDI; in aviation upto 49%, in Broadcast sector upto 74%, in multi-brand retail upto 51% and in single-brand retail upto 100%.[16] Foreign direct investment and the developing world FDI provides an inflow of foreign capital and funds, investment in addition to an increase in the transfer of skills, technology, and job opportunities.[citation needed] Many of the Four Asian Tigers benefited from investment abroad.[citation needed] A recent meta-analysis of the effects of foreign direct investment on local firms in developing and transition countries suggest that foreign investment robustly increases local productivity growth.[17] The Commitment to Development Index ranks the "development-friendliness" of rich country investment policies. Foreign Investment in India is announced by Government of India named as FEMA(Foreign Exchange Management Act)

Labels:

2012,

2013,

India News,

It News,

News,

What's New

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment